Table Of Content

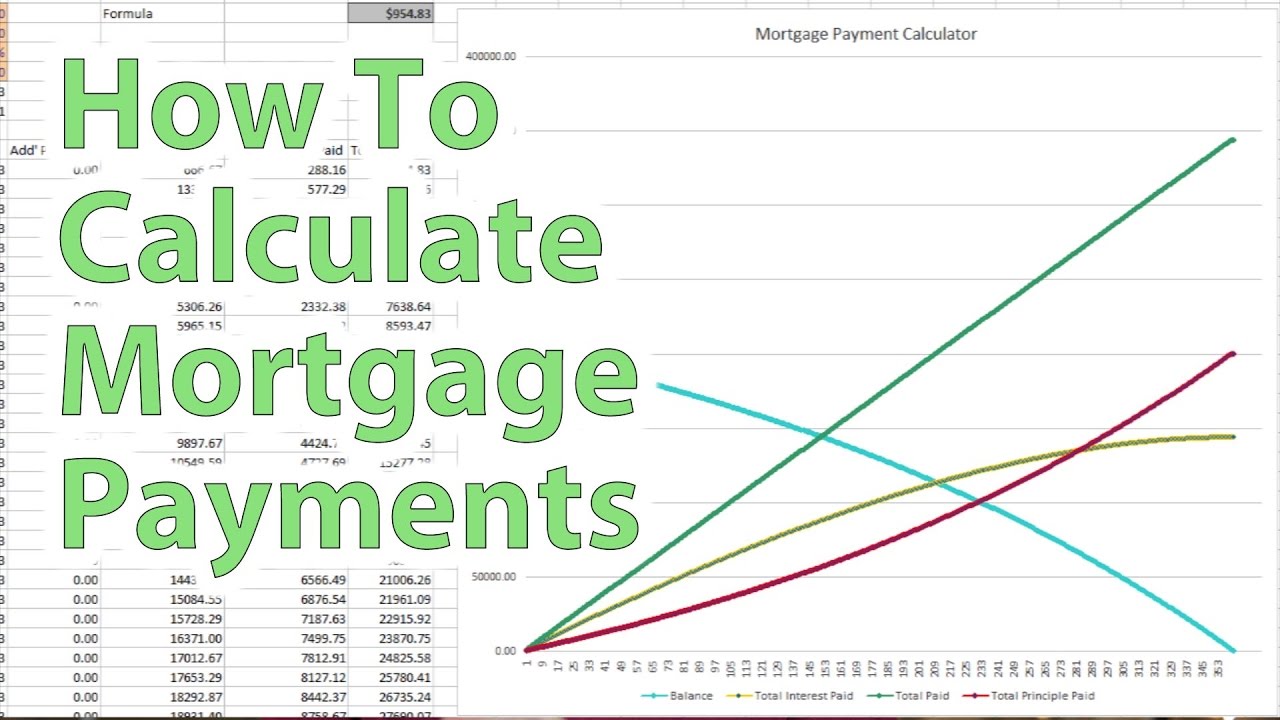

However, some loans are issues for shorter terms, such as 10, 15, 20 or 25 years. For example, for that same $200,000 house with a 4.33 percent interest rate, your monthly payment for a 15-year loan would be $1,512.67, but you would only pay $72,280.12 in interest. You would also pay off your loan in half the time, freeing up considerable resources. You don’t have to accept the first terms you get from a lender.

Comparing common loan types

Once you reach at least 20% equity, you can request to stop paying PMI. While it depends on your state, county and municipality, in general, property taxes are calculated as a percentage of your home’s value and billed to you once a year. In some areas, your home is reassessed each year, while in others it can be as long as every five years.

Next steps: Start the home loan process

A mortgage is a loan to help you cover the cost of buying a home. Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site.

What taxes are part of my monthly mortgage payment?

If you have a student loan, a lender may allow up to 50 percent. For instance, let’s say the conforming limit for a 2-unit home in your area is $653,550. If you take a $800,000 mortgage, this is considered a jumbo loan. Lenders require a much higher credit score to secure a jumbo mortgage. They also employ stricter background checks on borrowers before approving loans.

After closing, you’ll make monthly payments—which covers principal, interest, taxes and insurance. If you default on the mortgage, the bank will have the ability to foreclose on the property. When you take out a conventional mortgage, most lenders will expect some kind of down payment. A down payment is a percentage of the entire loan amount you pay upfront before closing on the mortgage. To avoid paying private mortgage insurance (PMI) on a conventional loan, lenders expect a down payment of at least 20%.

We recommend keeping your mortgage payment to 25% or less of your monthly take-home pay. For example, if you bring home $5,000 a month, your monthly mortgage payment should be no more than $1,250. Using our easy mortgage calculator, you’ll find that means you can afford a $211,000 home on a 15-year fixed-rate loan at a 4% interest rate with a 20% down payment. A mortgage is a secured loan that is collateralized by the home it is financing. This means that the lender will have a lien on your home until the mortgage is paid in full.

How To Choose the Right Mortgage Term for You

Michigan Mortgage Calculator - The Motley Fool

Michigan Mortgage Calculator.

Posted: Thu, 07 Mar 2024 08:00:00 GMT [source]

Over the length of the loan, though, the 15-year loan is a far better deal, considering the interest you pay — $514,715 in total. With the 30-year, you pay $646,624 total — over $100,000 more. Each month we’ll pay $2,859.53, over 60% more than with the 30-year loan.

I think it puts too much pressure on kids who are under enough pressure at exam time. Parents should encourage their kids to do the best they can, not add to their stress levels. The move was made to reflect the store is for everybody, said brand ambassador Josie Gibson. Readers were split - with some feeling so strongly that they're prepared, they suggest, to sacrifice those frozen Greggs steak bakes forever...

Homeowners Insurance

If you have an escrow account, you pay a set amount toward these additional expenses as part of your monthly mortgage payment, which also includes your principal and interest. Your mortgage lender typically holds the money in the escrow account until those insurance and tax bills are due, and then pays them on your behalf. If your loan requires other types of insurance like private mortgage insurance (PMI) or homeowner's association dues (HOA), these premiums may also be included in your total mortgage payment. A mortgage is a loan secured by property, usually real estate property. Lenders define it as the money borrowed to pay for real estate.

When it comes to interest rates, jumbo mortgages usually have higher rates than conventional loans. But depending on market conditions, lenders may offer competitive rates similar to conventional loans to encourage sales. For example, if you take a 5/1 ARM, you’ll pay a fixed rate for 5 years. This means your monthly payment may either increase or decrease, depending on the market index. If you choose an ARM, you must prepare for increasing payments.

Back-end DTI ratio is estimated by adding mortgage-related debts and all monthly debt payments. Another important lending criteria is debt-to-income (DTI) ratio. DTI ratio is a percentage that compares your debts to the amount of your monthly earnings. A higher DTI ratio means your debt takes a considerable portion of your income. Likewise, a low DTI ratio means better chances of securing a conventional loan. In general, a longer term duration imposes higher interest rates.

Generally, the more frequently compounding occurs, the higher the total amount due on the loan. Use the Compound Interest Calculator to learn more about or do calculations involving compound interest. They have greater chances of defaulting on a loan, especially during economic down times. On the other hand, a high score gives you access to more competitive rates. According to the 2008 Housing and Economic Recovery Act (HERA) conforming limits must be adjusted annually to accurately show changes in average house prices.

How much house you can afford depends on several factors, including your monthly income, existing debt service and how much you have saved for a down payment. When determining whether to approve you for a certain mortgage amount, lenders pay close attention to your debt-to-income (DTI) ratio. Unless you come up with a 20 percent down payment or get a second mortgage loan, you will likely have to pay for private mortgage insurance.

Active-duty members and veterans can qualify with a credit score of 620. Due to government sponsorship, VA loan rates are usually lower than conventional loan rates. This way you’ll know beforehand if you’re eligible for a conventional loan. Make sure to review any inaccurate payment records on your report. Correcting information can also help raise your credit score. Borrowers can get a free copy of their credit report every 12 months.

If the collateral is worth less than the outstanding debt, the borrower can still be liable for the remainder of the debt. Use this calculator to compute the initial value of a bond/loan based on a predetermined face value to be paid back at bond/loan maturity. Once the financial pieces are in place, it’s time to find your perfect home! While it’s one of the most exciting stages of the process, it can also be the most stressful. Buying too much house can quickly turn your home into a liability instead of an asset.

The higher your down payment, the less interest you pay over the life of your home loan. The best way to pay for a home is with a 100% down payment in cash! Not only does it set you up for building wealth, but it also streamlines the real estate process.